2024 Update!

Due to the large influx of residents from New York City, the prices of homes in Nassau County have taken a sharp increase, despite the high interest rates. One 3-bedroom, 2-bath home in Bellmore that was listed for $650,000 went into contract for $720,000 in a relativity short period. $70,000 more than was initially expected to sell for and this trend is being found throughout the county and some parts of Suffolk County as well.

Location, Location, Location

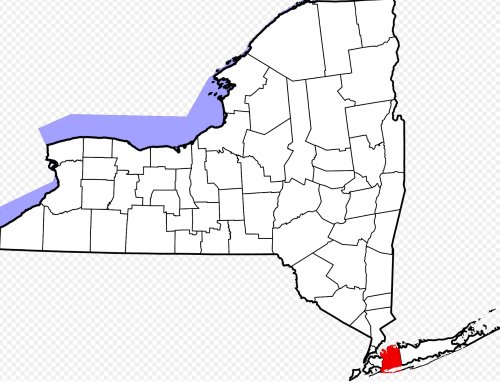

Nassau County has been known for having, on average, higher housing prices compared to other parts of the country. No doubt one reason is the county’s close proximity to New York City. For many in Nassau, a ride from their LIRR local station to Manhattan takes about 45 minutes, and for some, their total commute is shortened ever since the new LIRR station was built at Grand Central in 2022.

We should also keep in mind that real estate prices are always subject to change due to various economic factors and market conditions, such as the federal government’s raising of interest rates that went from below 2.0% in May 2022 to over 6.0% one year later.

But with that said, Nassau County offers a diverse range of housing options, from suburban neighborhoods to waterfront properties and exclusive communities. This diversity contributes to the variations in home prices throughout the county.

So What are the Prices of Houses in Nassau County?

According to data from the National Association of Realtors (NAR) in 2020, the median existing single-family home price in the Northeast region, which includes New York, was around $327,900. However, this is just a regional average and may not accurately represent the specific prices in Nassau County.

Certain areas within Nassau County, such as the North Shore and Gold Coast communities, are known for their affluent neighborhoods and higher-priced properties. These areas often feature large estates, waterfront homes, and proximity to amenities like golf courses and exclusive clubs. Consequently, prices in these neighborhoods can be significantly higher compared to other parts of the county.

On the other hand, there are more affordable housing options in certain towns and communities within Nassau County. These areas may include older homes, townhouses, condominiums, and more modestly sized properties. Prices in these neighborhoods can be relatively lower, providing opportunities for individuals and families looking for more affordable housing options in the county.

It’s worth noting that the real estate market is dynamic, and prices can fluctuate based on various factors such as changes in supply and demand, interest rates, and economic conditions. In 2020 and 2021, the impact of the COVID-19 pandemic on the housing market has had an influence on pricing trends, and just last year in 2022, a seller’s market existed and Nassau County properties were high. Now, a year later, housing prices have diminished due to the interest rate increases. It is worth noting that some areas in the county have not been affected as much as other areas with this downward trend since there is a current shortage of homes available in Nassau.

To get the most accurate and up-to-date information on home prices in Nassau County, it is recommended to consult with local real estate agents, check reputable real estate websites, or contact local appraisers who have access to the latest market data. They can provide insights specific to your desired location, property type, and current market conditions.

In Summary

The average price of a home in Nassau County tends to be higher than the national average. However, prices can vary significantly depending on the specific location, type of property, and market conditions. To obtain accurate and current pricing information, it is best to consult local real estate professionals who can provide the most relevant and up-to-date data for your specific needs.